2021 SPAC market update and opportunities for Asia Pacific

The special purpose acquisition company (SPAC) market has boomed over the past several years, with continued increases in IPO activity and record completions of de-SPAC transactions. More than 50% of total IPOs in 2020 were SPACs, this represents a 4x increase from the previous year. As of March 25, 2021, over 445 SPACs are looking for their target globally with an additional 225+ pending pricing and expected to complete in Q2 2021, meaning that over 670 SPACs are knocking on the doors of private companies or public companies looking to carve-out a business unit.

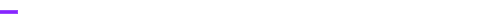

In this rapidly-evolving landscape, how should SPAC sponsors and Asia Pacific companies prepare? What are the associated risks stakeholders must not overlook when choosing the SPAC route vs. a traditional IPO? Donnelley Financial Solutions (DFIN) proudly organized its first APAC focused SPAC webinar on April 15, 2021, bringing together capital markets leaders from NYSE, J.P. Morgan, Latham & Watkins and PwC to discuss these topics:

- The SPACs market landscape – challenges and opportunities facing sponsors and target firms as 2021 unfolds

- Pros and cons of the SPAC route vs. traditional US IPO

- Readiness for the de-SPAC opportunity: what are the risks businesses must not overlook when choosing the SPAC route?

- Southeast Asia spotlight: a surge in SPAC activities and implications to stakeholders

- Factors leading to a successful merger into a SPAC. From accelerated filing & post-SPAC compliance, PIPE financing to accounting & controls standards and more.

Register to watch the webinar replay >

Duration: 1 hour

Date of recording: April 15, 2021

Language: English

Please fill out the form to access the webinar replay: